DNA

ISLAMABAD, JAN 28: Amidst the government claim of making efforts to improve efficiency the power sector situation remains grim despite putting an additional burden of Rs165 billion on consumers in the past one year by increasing electricity prices, as the country’s power sector circular debt has reached Rs2.55 trillion during first six months of July-Dec 2023-24 (2HCY23).

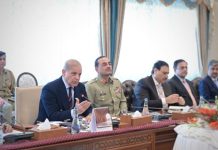

These views were expressed by the FPCCI former president and Businessmen Panel (BMP) Chairman Mian Anjum Nisar while addressing a meeting here on Sunday. Mian Anjum Nisar observed that the Discos’ losses and inefficiencies stood at Rs77 billion during July-December 2023-24 as compared to Rs62 billion in the same period of 2022-23, showing addition of Rs15 billion in total circular debt stock. The total amount of losses, inefficiency were Rs160 billion during FY 2022-23.

Discos’ under recoveries reached Rs149 billion during first half of 2023-24 as compared to Rs62 billion during corresponding period of 2022-23; however, their cumulative under recoveries stood at Rs236 billion as of June 30, 2023. Other adjustments were Rs74 billion during July-Dec 2023-24 against Rs246 billion in July-Dec 2022-23.

He said that in fiscal year 2022-23, the government provided Rs136 billion less in subsidies as against the requirements based on reduced rate of tariffs for various categories of consumers.

The government has recently prepared a plan to reduce the circular debt but the new plan, drawn up in consultation with the International Monetary Fund, shows that the circular debt reduction will largely hinge up increasing the electricity prices.

The BMP Chairman said that the continuous increase in the flow of the circular debt was against the promises of the government to bring the circular debt to zero. It is going to make another plan to reduce the debt, mainly by increasing electricity tariffs which is not the proper way to handle the issue.

Quoting the latest data, he said that circular debt which touched Rs2.31 trillion at the end of 2023-24, with a growth of Rs57 billion in stock, is now hovering at around Rs2.55 trillion with a growth of Rs241 billion against growth of Rs283 billion in the same period of 2022-23.

He said that payables to power producers have reached Rs1.673 trillion during first six months of CFY from Rs1.434 trillion at the end of FY 2022-23, showing addition of Rs239 billion. The stock of payables to IPPs was Rs1.673 trillion during the corresponding of FY 2022-23.

GENCO’s payables to fuel suppliers have increased by Rs14 billion to Rs112 billion during CFY 2023-24 as compared to Rs98 billion during the corresponding period of 2022-23. No change was witnessed in Rs765 billion parked in Power Holding Limited (PHL).

He said, main reason for the substantial growth in flow of circular debt is issues of K-Electric (KE), AJ&K, release of subsidies, delay in implementation on QTA adjustments, higher interest payments, dollar rates, etc. IMF has asked the authorities to notify regulator tariff adjustments.

He said, Rs336.4 billion is receivable from KE as on December 2023 as recently ECC approved Rs50 billion on account of KE’s QTA which were used by CPPA-G to clear its liabilities.

According to reports, the amount of budgeted but unreleased subsidies was Rs10 billion during the first six months of current fiscal year against Rs82 billion in the same period of 2022-23. There were no unclaimed subsidies during first half of current fiscal year despite the fact that an amount of Rs70 billion was unclaimed in 2022-23 and Rs17 billion during July-December 2022-23.

Mian Anjum Nisar said that the power sector circular debt issue should be resolved holistically without escalating electricity cost, as its size has more than doubled during the three and a half years in spite of raising the power tariff multiple times in the past. At present, oil and gas sectors are reeling from Rs1.8 trillion worth of circular debt whereas the power sector has a circular debt close to Rs2.5 trillion. The rising gas demand forced the previous government to divert expensive LNG to the residential consumers in winter. However, there was no mechanism in place to recover dues from the domestic sector.

He added that IPPs interest charges (PHL and IPPs) were Rs58 billion in six months of current fiscal year against Rs85 billion in the same period of 2022-23.The amount of IPPs interest charges was Rs143 billion during the entire fiscal year 2022-23.

Pending generation cost (QTAs and FCAs) stood at Rs187 billion against Rs118 billion during the same period of 2022-23 and Rs250 billions of FY 2022-23.

Non-payment by K-Electric was Rs9 billion in July-December 2023-24 against Rs91 billion during the same period of FY 2022-23.

The cumulative financial impact of interest charges (PHL and IPPs), pending generation cost (QTA and FCA), non-payment by K-Electric, Discos losses/ inefficiency, Discos under recoveries stood at Rs378 billion during the first half of current fiscal year as compared to Rs318 billion during the same period of 2022-23 and Rs220 billions of entire fiscal year 2022-23. He further stated that payables to power producers increased by Rs5 billion due to withdrawals by FBR in April 2023.