By Kara Diaby

African diaspora remittances have become a major component of financing African economies. Since 2010, these transfers have experienced significant growth, reflecting the increasing importance of diasporas in financially supporting their countries of origin. Here is my detailed analysis of the evolution of these financial flows, their economic and social impact, as well as regional and national disparities.

Between 2010 and 2023, remittances to Africa saw substantial growth. In 2010, remittances amounted to just over 50 billion USD, while by 2023, they reached 91.66 billion USD. This progression reflects several key factors:

Between 2010 and 2023, remittances to Africa saw substantial growth. In 2010, remittances amounted to just over 50 billion USD, while by 2023, they reached 91.66 billion USD. This progression reflects several key factors: Northern Africa: With countries like Egypt and Morocco, this region is the main beneficiary of remittances, receiving more than 46% of the total amount sent to Africa. Historical and cultural ties with Europe and the Middle East facilitate these financial flows.West Africa: This region receives more than 36.5% of remittances, with Nigeria, Senegal, and Ghana leading the way. The diasporas from these countries are widely dispersed across North America, Europe, and the Middle East.East Africa: Accounts for about 13% of remittances, with Kenya, Uganda, and Ethiopia as the main beneficiaries.Central Africa: Remittances represent 2% of the total African transfers, reflecting either a smaller diaspora or obstacles to financial transactions in the region.Southern Africa: With countries like South Africa and Zimbabwe, this region receives around 2% of remittances, showing a slight increase in recent years.These differences reflect variations in migration patterns, the size of the diasporas, economic policies, and the ease of financial transactions in each region.3. Impact of COVID-19 on Remittances Variations between 2019 and 2023: The COVID-19 pandemic had a significant impact on global economies, but remittances to Africa showed remarkable resilience:

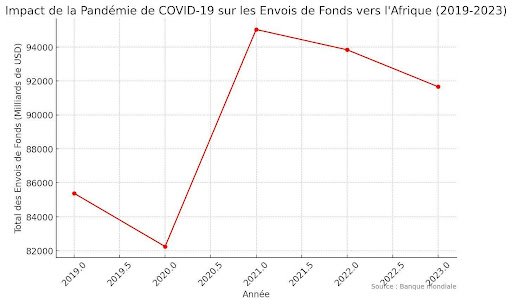

Northern Africa: With countries like Egypt and Morocco, this region is the main beneficiary of remittances, receiving more than 46% of the total amount sent to Africa. Historical and cultural ties with Europe and the Middle East facilitate these financial flows.West Africa: This region receives more than 36.5% of remittances, with Nigeria, Senegal, and Ghana leading the way. The diasporas from these countries are widely dispersed across North America, Europe, and the Middle East.East Africa: Accounts for about 13% of remittances, with Kenya, Uganda, and Ethiopia as the main beneficiaries.Central Africa: Remittances represent 2% of the total African transfers, reflecting either a smaller diaspora or obstacles to financial transactions in the region.Southern Africa: With countries like South Africa and Zimbabwe, this region receives around 2% of remittances, showing a slight increase in recent years.These differences reflect variations in migration patterns, the size of the diasporas, economic policies, and the ease of financial transactions in each region.3. Impact of COVID-19 on Remittances Variations between 2019 and 2023: The COVID-19 pandemic had a significant impact on global economies, but remittances to Africa showed remarkable resilience: 2019: Remittances reached a record high of $85.38 billion USD.2020: Despite pessimistic forecasts, the decline was limited to $82.25 billion USD, representing only a 3.7% drop.2021: A spectacular rebound to $95.03 billion USD, marking a 15.5% increase compared to 2020.2022: Remittances slightly decreased to $93.84 billion USD, likely due to the post-pandemic economic stabilization.2023: Remittances were estimated at $91.66 billion USD, showing a slight decrease but remaining at high levels.Several factors explain this resilience:

2019: Remittances reached a record high of $85.38 billion USD.2020: Despite pessimistic forecasts, the decline was limited to $82.25 billion USD, representing only a 3.7% drop.2021: A spectacular rebound to $95.03 billion USD, marking a 15.5% increase compared to 2020.2022: Remittances slightly decreased to $93.84 billion USD, likely due to the post-pandemic economic stabilization.2023: Remittances were estimated at $91.66 billion USD, showing a slight decrease but remaining at high levels.Several factors explain this resilience: 75% of funds are used to cover immediate needs:

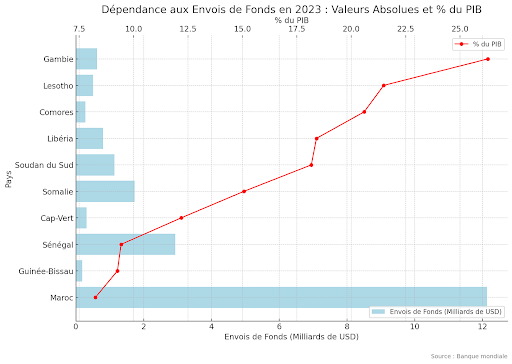

75% of funds are used to cover immediate needs: The analysis of financial flows to certain African countries in 2023 reveals a complex and multidimensional economic reality. It not only shows the dependence of these countries on remittances from their diasporas in terms of GDP percentage and absolute value, but also highlights the impact of these flows at the individual level.The case of Comoros perfectly illustrates this complexity. With remittances accounting for 20.60% of its GDP and an average amount of 330.49 USD per capita, this small island nation shows a marked dependence on remittances. This situation underscores the importance of these flows for the economic well-being of each Comorian citizen.Morocco presents a contrasting profile. Although receiving the highest absolute value of remittances (12.13 billion USD), these transfers represent only 8.25% of its GDP. However, the per capita impact remains significant at 321.64 USD, reflecting the strong commitment of the Moroccan diaspora to their home country, despite a more diversified national economy.Lesotho and The Gambia embody cases of high relative dependence. With 21.49% and 26.28% of their GDP coming from remittances respectively, these nations show notable economic vulnerability. For Lesotho, this translates into 238.10 USD per capita, highlighting the importance of these funds for households in this landlocked country, despite a relatively modest total of 510 million USD in remittances.Senegal, with 2.94 billion USD in remittances, shows a more moderate per capita impact (167.09 USD), partly due to its larger population. Nevertheless, these transfers remain a crucial pillar of the Senegalese economy, supporting many households across the country.These figures indicate that in some countries, remittances represent a substantial part of the national economy and are essential for citizens’ well-being. However, heavy reliance on these flows can present challenges in the event of fluctuations.6. Strategic role of the DiasporaEconomic and social contributionBeyond financial transfers, the African diaspora plays a multifaceted role in the development of their home countries:

The analysis of financial flows to certain African countries in 2023 reveals a complex and multidimensional economic reality. It not only shows the dependence of these countries on remittances from their diasporas in terms of GDP percentage and absolute value, but also highlights the impact of these flows at the individual level.The case of Comoros perfectly illustrates this complexity. With remittances accounting for 20.60% of its GDP and an average amount of 330.49 USD per capita, this small island nation shows a marked dependence on remittances. This situation underscores the importance of these flows for the economic well-being of each Comorian citizen.Morocco presents a contrasting profile. Although receiving the highest absolute value of remittances (12.13 billion USD), these transfers represent only 8.25% of its GDP. However, the per capita impact remains significant at 321.64 USD, reflecting the strong commitment of the Moroccan diaspora to their home country, despite a more diversified national economy.Lesotho and The Gambia embody cases of high relative dependence. With 21.49% and 26.28% of their GDP coming from remittances respectively, these nations show notable economic vulnerability. For Lesotho, this translates into 238.10 USD per capita, highlighting the importance of these funds for households in this landlocked country, despite a relatively modest total of 510 million USD in remittances.Senegal, with 2.94 billion USD in remittances, shows a more moderate per capita impact (167.09 USD), partly due to its larger population. Nevertheless, these transfers remain a crucial pillar of the Senegalese economy, supporting many households across the country.These figures indicate that in some countries, remittances represent a substantial part of the national economy and are essential for citizens’ well-being. However, heavy reliance on these flows can present challenges in the event of fluctuations.6. Strategic role of the DiasporaEconomic and social contributionBeyond financial transfers, the African diaspora plays a multifaceted role in the development of their home countries: