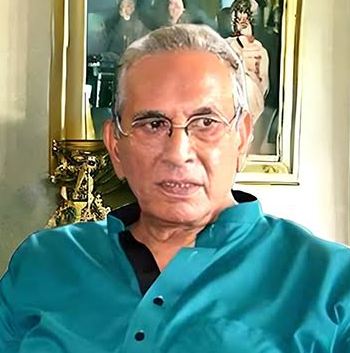

ISLAMABAD, MAY 6 /DNA/ – Business leader and former President of the Islamabad Chamber of Commerce and Industry (ICCI), Dr. Shahid Rasheed Butt, on Tuesday strongly criticized the recent changes in tax laws, stating that granting authoritarian powers to tax authorities without consulting the business community will not increase revenue; instead, it will likely lead to a decline.

He issued a stark warning that this decision would not only eliminate the remaining investments in the country but also hasten the alarming outflow of capital, jeopardizing its economic stability.

Addressing an emergency meeting of traders and industrialists, Shahid Rasheed Butt said that amendment in tax laws violates the fundamental rights of the business community, which is currently protesting against it.

The government must reverse the move before our patience runs out because, instead of institutional reforms, the policy of granting unchecked powers to officials amounts to a declaration of war against the business community.

He stated that the authoritarian powers given to tax officials are blatant proof of an anti-business agenda. Exploiting the business sector under the guise of tax collection is unacceptable. We reject the crushing of the business community under the cover of legal authority. Those in power must consider implications, he warned.

The business leader explained that under the ordinance, the FBR now has the authority to freeze bank accounts, seize business documents, attach movable and immovable properties, and arrest taxpayers without court approval.

He added that these powers contradict the basic principles of the Constitution, personal liberty, and due process. Pushing away traders and investors from the government is a dangerous attempt.

He further noted that this measure will make doing business in Pakistan even more difficult. FBR is already facing a credibility crisis. He emphasized that granting it more powers without institutional reforms would prove economically disastrous.

He recalled that such steps have been used to harass the business community, resulting in economic uncertainty and mistrust.

Shahid Butt stressed that if the government genuinely wishes to expand the tax net, it must adopt friendly and trust-based policies. “No one pays taxes or invests in an atmosphere of fear. We need transparency, simplicity, and accountability in FBR’s conduct, not threats and coercion,” he said. He cautioned that this action could further dissuade local and foreign investors, who are already disheartened by the economic instability that has gripped the country.

Shahid Rasheed Butt demanded that the ordinance be immediately withdrawn and thoroughly reviewed, insisting that no legislative action should be taken without first consulting the business community.

He stated that if the decision is not reversed, the trader community will have no choice but to take to the streets in protest.

He urged the media, civil society, and political parties to oppose these measures, which will harm businesses, the economy, revenue, and jobs.

Shahid Rasheed Butt emphasized that sustainable tax reforms cannot be achieved through fear and suppression. True economic revival depends on dialogue, trust, and mutual respect between the state and its entrepreneurs.

With an already unfair and corrupt tax system hindering growth and investment, the new coercive measures will likely add to compliance and enforcement challenges rather than resolve the existing issues.