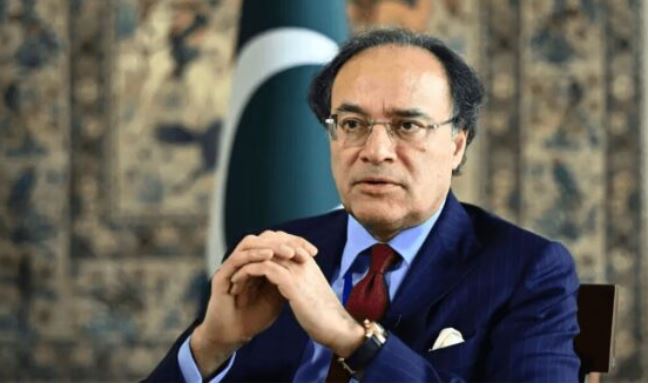

ISLAMABAD, JAN 8 (APP/DNA): Minister for Finance and Revenue Senator Muhammad Aurangzeb on Thursday held a meeting with Visa delegation led by Tareq Muhmood, Regional President for Central Europe, Middle East and Africa (CEMEA) and discussed advancing digital payments, financial inclusion, and ongoing economic reforms.

The minister welcomed the delegation and appreciated Visa’s continued engagement with Pakistan’s financial sector. The discussion focused on Pakistan’s improving macroeconomic indicators, ongoing stabilization efforts, and the government’s priorities for achieving sustainable and inclusive economic growth, said a news release.

Aurangzeb briefed the delegation on progress made under the International Monetary Fund (IMF)-supported program, external validation from international credit rating agencies, and the government’s reform agenda covering taxation, energy, state-owned enterprises, public debt management, and privatization, including recent steps taken to accelerate the privatization process.

Both sides exchanged views on the acceleration of Pakistan’s digital transformation, with particular emphasis on digital infrastructure, payment systems, and the digitization of government payments, it added.

Aurangzeb highlighted that digitalization is being led at the highest level by the Prime Minister to ensure coordinated, cross-government implementation.

He outlined ongoing initiatives including the establishment of the Pakistan Digital Authority, reforms in payment rails under the State Bank of Pakistan, and efforts to digitize government receipts and expenditures to enhance transparency, efficiency, and service delivery.

The Visa delegation shared insights from their engagement with banks, fintechs, and other stakeholders in Pakistan, noting strong confidence driven by macroeconomic stabilization and growing interest in expanding digital payments, financial inclusion, and innovation.

Discussions covered cash displacement, fraud prevention, support for small and nano businesses, QR and tap-to-phone solutions, and the importance of expanding acceptance infrastructure, particularly in Tier-2 and Tier-3 cities.

The delegation also emphasized the value of maintaining optionality and competition across payment channels to foster innovation, manage risk, and deliver better outcomes for consumers and merchants.

The meeting also addressed emerging areas such as remittances, e-commerce, tourism-related spending by overseas Pakistanis, and the potential use of new technologies including blockchain and digital assets within a regulated framework.

The minister noted that Pakistan is examining these developments carefully, balancing innovation with financial stability and regulatory oversight, and shared perspectives on potential use cases including public debt, remittances, and government payments.

Both sides reaffirmed their commitment to continued collaboration, including technical engagement and knowledge-sharing on government payments digitization and financial inclusion initiatives.

The meeting concluded with an understanding to maintain close coordination between Visa, the Ministry of Finance, and relevant regulators to support Pakistan’s digital payments ecosystem and broader economic reform and growth agenda.

The visiting Visa delegation also included Leila Serhan, Senior Vice President NALIP; Joanne Kubba, Senior Vice President Government Affairs CEMEA; Umar Khan, Country Manager Visa Pakistan; and Nauman Majeed, Visa Government Sales.