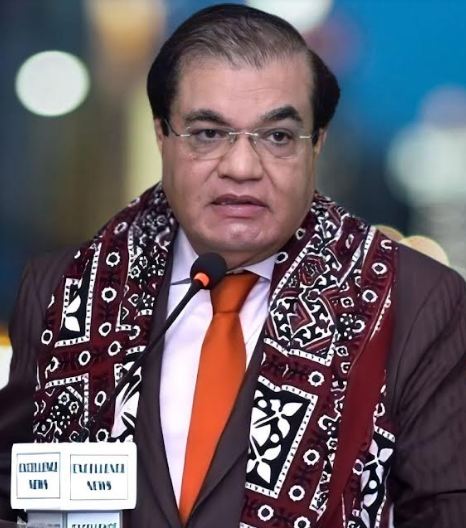

KARACHI, JUN 14 /DNA/ – Chairman of National Business Group Pakistan, President Pakistan Businessmen and Intellectuals Forum, and All Karachi Industrial Alliance Mian Zahid Hussain, and former provincial minister, said on Friday that the federal budget is inconsistent with the recent announcements of economic managers, the prime minister’s promises, and public expectations.

He said that the budget would harm the people and have disappointed the community. It needs to be made clear whether the government wants economic development or whether its priority is economic stability.

Mian Zahid Hussain said that the burden on taxpayers has once again been increased by 3500 billion rupees, which is tantamount to encouraging tax evaders.

Talking to the business community, the veteran business leader said that tax defaulters have not been targeted in the budget, which is unfortunate.

The revenue target has been greatly increased, but neither has there been any reduction in government expenditures, nor have any of the concessions of 3.9 trillion been withdrawn. The deficit has been estimated at Rs 8500 billion.

The business leader said that nothing has been done in the budget to collect tax from non-paying sectors, and instead of collecting tax directly from retailers, it was decided to collect withholding tax through manufacturers.

Collecting taxes from manufacturers will hit them as well as the masses, as it will increase inflation. Various types of penalties have been announced for those who do not pay taxes, but no effective plan for digitizing the economy has been announced.

Mian Zahid Hussain said that for the last five years, the income of the salaried class has been continuously decreasing, but their tax has been increased, which will increase their problems.

In this budget, instead of reducing the cost of doing business for exporters, taxes have been increased, and they have been left at the mercy of the FBR.

Similarly, the export facilitation scheme has been eliminated for local supply, which will reduce exports. A cruel eighteen per cent sales tax has been imposed on hundreds of health sector items.

The government’s commitment to economic reforms does not appear to be as it was claimed. Nothing has been done to increase the tax base, and reliance has been placed on sources of revenue growth that will fuel inflation.

The problems of the industrial and agricultural sectors will also increase due to the budget, and the investment environment will be affected.