DNA

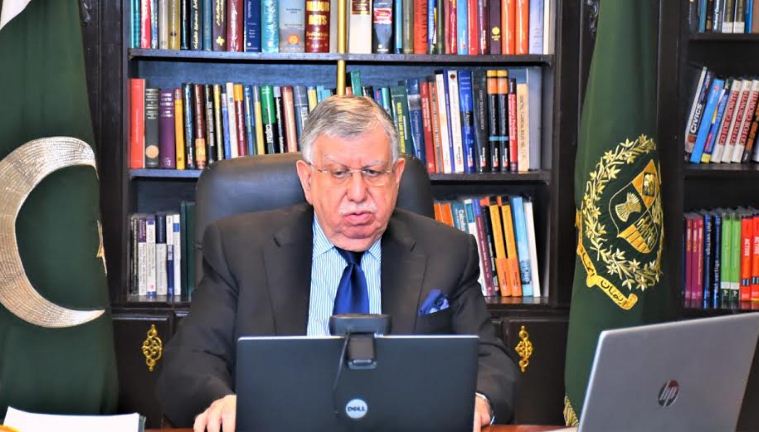

ISLAMABAD – I would like to thank the Headquarters Southern Command for inviting me as a guest speaker to talk about Pakistan’s Economy at National Workshop Balochistan-7, Federal Minister for Finance Shukat Tarin said.

It is my profound privilege and pleasure to address this august gathering and to enlighten you about the economic progress Pakistan has made during the last 3 years despite significant challenges; first due to stabilization measures and then COVID 19 outbreak. There is a strong linkage between a country’s national security and economic security which in turn ensures sustainable economic development.

The present government is strongly committed to manage the national economy in a most efficient and effective manner, both at the Macro and Micro levels, to achieve higher sustainable and inclusive economic growth. In this regard, the government has devised a comprehensive set of economic reforms across all sectors of the economy. We have achieved macroeconomic stability and now we are moving towards the higher growth trajectory.

Challenges We Inherited

It is a matter of record that the Present Government inherited an economy in crisis with significantly higher macroeconomic imbalances. Current account deficit of $20 billion was highest ever. Imports were at about $56 billion were 224 % of exports of $25 billion, compared to 162 % in 2012-13. Higher imports were subsidized by an over-valued exchange rate which remained constant at Rs.104 for nearly five-year period. During this period, exports growth was negative 0.14 % while imports grew by more than 100 %. The debt and liabilities, which stood at Rs.16 trillion as on 30-6-2013, rose sharply to reach about Rs.30 trillion as on 30-6-2018, reflecting an increase of Rs.14 trillion or 88 %. Static tax to GDP ratio and fiscal deficit was on increasing trend. Inflation had started to accelerate due to heavy deficit financing from SBP and devaluation of PKR. Foreign reserves, largely built on borrowing, rose from $6 billion in June 2013, to nearly $20 billion in late 2016, but then sharply declined to $10 billion by end June 18. Despite clearing a mammoth circular debt of Rs.485 billion through cash payments, a huge circular debt of Rs.1.2 trillion was again accumulated. Claim of achieving higher growth was nothing but built on heedless borrowing, over-valued exchange rate, low interest rates and unprecedented borrowings from the State Bank.

Our biggest challenge was to fulfil our international obligations, avoid default and to achieve sustainable macroeconomic stability. The government took some difficult policy decisions to avert the crisis and laid the foundation of strong and sustainable economy through bilateral arrangements, multilateral program, IMF program and deferred oil payments.

Similarly current account deficit was managed through exchange rate correction, export industry incentives and duties imposed to curtail luxury import items, Rationalization of energy prices, prudent expenditure management through austerity measures, no supplementary grants and Zero borrowing from SBP.

These measures paid off in terms of improved external and fiscal accounts, stability in exchange market and growing investor confidence.

What We Have Achieved:

We have moved from stabilization to higher growth. After considerable efforts, the government has succeeded in stabilizing the economy and putting it on optimal growth path. The COVID-19 brought multifaceted challenges for Pakistan. Pre COVID, the global economy was projected to grow by 3.4 % in 2020 but due to COVID-19, global growth contracted by 3.3%. World’s top most economies such as the US (-3.5 %), Euro Area (-6.6 %), UK (-9.9 %), Japan (-4.8 %) and many others suffered badly. The economic growth contracted by 0.47 % in FY2020. Pakistan has contained adverse effects of the pandemic on the economy and vulnerable segments of the society through appropriate measures. The government announced the largest ever Fiscal Stimulus package of Rs 1,240 billion. This package was also complemented by liquidity support for industry especially SMEs from SBP. In addition, a Construction package for low-cost housing & jobs creation was also announced due to its high employment capacity. As a result, Pakistan has largely escaped the devastation and bounce back compared to its peers in the region.

The Economic Turnaround

The economy rebounded strongly in FY2021 and posted growth of 3.94 % on the basis of 2.77, 3.57 and 4.43 % growth in agriculture, industrial and services sectors, respectively. Agriculture showed a historic performance. Performance of crops like wheat, rice, and maize were exceptionally higher while sugarcane was the second highest in country’s history. Industry also showed tremendous performance. LSM recorded growth not seen in more than a decade. It has posted a growth of 12.8 % during Jul-Apr FY 2021 (-8.7 % same period last year). Similarly, the growth in cement dispatches increased by 20.9 %, oil sales 18.0 %, car production 49.7 % and tractor production 59 % etc. The performance reflects robust economic activities without any disruption. Inflation rate has been contained at 8.8 % during July-May FY2021 against 10.9 % last year due to vigilant monitoring by NPMC and district administration. Tax collections has shown remarkable growth of 18 % which has crossed the psychological barrier of Rs. 4,000 billion which is not based on holding back of refunds. The comfortable external balance position of Pakistan has been supported by surplus current account balance on the back of robust flow of remittances and a sustained recovery in exports. Current account deficit of $ 4.3 billion (-1.8 % of GDP) in July-May, FY2020 turned into surplus of $ 0.2 billion (0.1 % of GDP) during July-May, FY2021. Exports increased by 10.3 percent to $ 23.1 billion in Jul-May FY2021 against $ 21.0 billion in the same period of last year. Pakistan has been placed among the top ten recipient countries that received most remittances in 2020 and its share as a percent of GDP increased to 9.9 % During July-May FY2021, remittances soared to $26.7 billion posting a growth of 29.4 %. The improvement in the current account led to increased foreign exchange liquidity in the interbank market thus reflected in a build-up in the country’s foreign exchange reserves. During the year, all three major credit rating agencies, Moody’s, Fitch and Standard & Poor’s, reaffirmed their sovereign credit Ratings for Pakistan. This reaffirmation is reflective of the sound policies of the Government and of the confidence reposed by these leading international institutions in the country’s economic outlook. Pakistan has met 26 out of 27 FATF conditions due to strict compliance and prudent reforms.

Budget 2021-22

It is heartening to say that our commitment and hard work has supported us to successfully complete the stabilization phase. Now the Budget 2021-22 is a growth-oriented budget based on a strategy to stimulate economic growth, with a clear roadmap of strategic priorities, revenue and expenditure plans. The growth target for FY2022 is set at 4.8 %. To attain this higher inclusive and sustainable economic growth, the government has set its priorities in the current budget across different sectors:

Sector Specific Measures

Agriculture

Agriculture will be the mainstay of our development due to its linkages with employment, trade and food security. In this regard, we will take steps in the following areas. These are: seeds, agriculture credit, fertilizer, mechanized farming, agro-based industries, cold chains and storage and a network of agri-malls spread across the country to eliminate the roll of middle man. An additional amount of Rs. 25 billion is being allocated for the development of agriculture sector.

Industry

In order to provide a boost and further strengthen the industrial economy we are giving concessions to this sector. Major exemptions are given on raw material of worth Rs 45 billion with an aim to increase the competitiveness of this important sector of the economy. Fixed tax scheme and simplified tax return for manufacturing SMEs and risk sharing and collateral and free lending to SME, various schemes have been envisaged for which an allocation of Rs 12 billion has been made. Special electricity tariffs have been provided for industrial use. We will make CPEC the platform where industries will be relocated. We are bringing a new Auto policy and introducing “Meri Gari Scheme”. As part of Auto Policy Incentives, tax relief earlier given to the auto sector for the vehicles upto 850 cc is being extended to 1000 cc vehicles. On textile products, the tax has been reduced from 12 to 10%. Under the construction package the ratio of income tax has been reduced from 35% to 20%. Tax relief has also been given to oil refineries so that they could turn to Euro-5 fuel.

Export Promotion

Export promotion is a key component in our growth strategy. In this regard, we are taking various initiatives which include the taxes imposed on exporters have been rationalized and incentives are given in value added products. New products have been introduced in order to enhance our export base: like auto spare parts, Two Wheelers, Pharmaceutical industry and cement. We are making IT industry as the future to lead our exports. For this purpose Export of IT and IT enabled services have been brought under the ambit of 100% tax credit. Investment will be made in Special Economic Zones and Special Technology Zones and allocation of Rs 20 billion for payment of DLTL claims.

Housing and Construction

The PM‟s housing and construction package has spurred a flurry of economic activities in this sector and its allied industries. The government has introduced a comprehensive construction package. Under the New Pakistan Housing Scheme, a subsidy of Rs 30 billion is being provided for the construction of low cost houses.

Energy

The country is faced with an unusual expansion in generation capacity which is imposing unbearable fixed capacity charges, impossible to be passed onto consumers. This situation is posing risks to the larger health of the economy and hence it is imperative to solve these problems on war-footing. We have formulated a circular debt management plan. It includes curtailing line losses and improving recoveries. We will continue to provide subsidies to low income electricity consumers through targeted subsidies. We are focusing on improving the transmission and distribution system.

Resource Mobilization

For the next fiscal year, tax collection has been fixed at Rs 5,800 billion. We will achieve this target by eliminating face-to-face contact through automation and use of technology, Universal Self-Assessment Scheme and Third party Audit, Tax defaulters may face legal action if they do not pay their taxes. Only a committee headed by the Finance Minister will have the authority to arrest him. 12 withholding taxes have been withdrawn as these are regressive in nature.

Development budget (PSDP)

The government has enhanced the development budget from Rs 630 billion to Rs 900 billion with the aim to boost economic growth, reduce unemployment and poverty thus leading to inclusive growth. The development priorities include Energy, Water, Transport and Communication, SDGs, Health and Education. In addition, allocation for Development Plan include development plan for Southern Balochistan, Karachi Transformation Plan, Gilgit Baltistan, 14+ Priority Districts of Sindh and Newly Merged Districts of Khyber Pakhtunkhwa.

Fiscal Discipline

We will bring down the budget deficit to 6.3 % of GDP in FY2022 from 7.1 %. The primary deficit would be brought down to 0.6 % of GDP. We have made a total reduction in primary deficit of 3.2 % in three-years from 3.8 % in FY2019. It shows that we have maintained the sanctity of the budget and better discipline in the use of government funds.

Social Security

We intend to change the course of history by using bottom up approach instead of leaving vulnerable segments to the mercy of trickle-down effect. In this regard, the new development package announced in the budget 2021-22 is going to be a game changer for common man – providing loans to farmers, job opportunities to the youth, houses to the low-income group and Sehat Health Card; thus upgrading the lifestyle of our masses. At present poor and middle class households have limited access to loans. To solve this problem we have decided to use the resources of the banking sector as a wholesaler. Through this way the poor and middle class household would have an access to banking sector. The government will bear the mark-up cost and will provide the guarantees. For the first time in the history of the country, under this growth model, we will bring financial resources to the doorsteps of the poor. Through this action, we are giving a comprehensive package to the low-income people – slogan of which was raised by many leaders in the past, but nothing was given. It is a matter of great achievement for us that we have significantly improved social sector allocations particularly cash transfer program under Ehsaas which is a major initiative of the government for social protection and poverty alleviation. For Ehsaas programme Rs 260 billion are being allocated in the budget 2021-22. This by far is the largest allocation and reflects the vision of the Prime Minister to help the extreme poor segments of our society. World Bank recognizes Ehsaas Emergency Cash among top 4 social protection interventions globally in terms of number of people covered

Way forward

At the end, I must say that we don’t just need growth, but we need an inclusive and sustainable growth. In the medium term, the growth target is set at 6-7 percent. The realization of this goal requires economic stability. The government is committed to ensure that the growth momentum remains intact. Our development plan is for enabling the country to stand on its feet. It will put the economy on a higher growth trajectory; with growth being generated not by stoking consumption through borrowing, but through higher investment, efficiency and enhanced productivity. In this regard, measures are being focused on establishing and strengthening an economy which is not only self-reliant but also capable of competing with its competitors globally.