ISLAMABAD, OCT 21: /DNA/ – Prime Minister Shehbaz Sharif has ordered the removal of a senior tax official after serious investigative lapses were found in a Rs 238.421 billion sales tax fraud case.

This is an unprecedented instance of direct executive oversight to enforce administrative accountability.

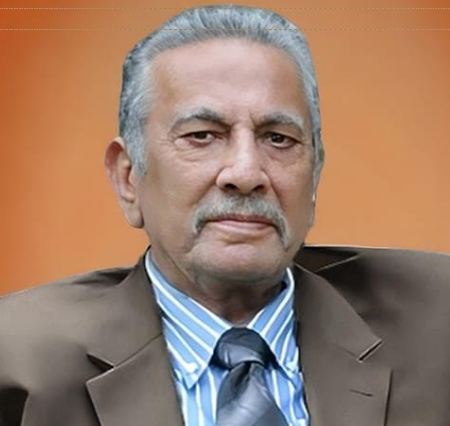

A Senior Auditor was dismissed from service after the Prime Minister’s Office (PMO) noticed grave negligence in probing a tax fraud case. This decision was made following a thorough review of the officer’s conduct and the severity of the case, said Shahid Rasheed Butt, former president of ICCI.

Among 13, six fraudulent beneficiaries received illegal input tax adjustments worth Rs 197.27 million. While Rs 117.41 million was recovered, Rs 79.86 million remained untraced due to the investigating officer’s inaction, he added.

Shahid Rasheed Butt said that despite working on the case since March 4, 2024, the officer made no meaningful effort to arrest suspects, while two key accused later secured bail, benefiting from the absence of any timely enforcement action. This inaction significantly hampered the progress of the case.

An inquiry confirmed that the final investigation report lacked substantive analysis, ignored pending banking information, and merely compiled pre-FIR facts. The disciplinary authority concluded that the lapses reflected inefficiency and indifference, not gaps in legal knowledge.

Rejecting the inquiry officer’s recommendation for a minor penalty, the authority imposed the significant penalty of removal from service.

This intervention is the second significant enforcement action by the Prime Minister within weeks. Earlier, another senior Inland Revenue Service officer was dismissed for allegedly accepting illegal gratification for refund processing.

Shahid Rasheed Butt said these steps form part of a broader accountability drive across revenue institutions, aligning with Pakistan’s commitments to the International Monetary Fund to strengthen anti-corruption controls.

Prime Minister Sharif has consistently emphasized that ‘business as usual’ is no longer acceptable in tax governance. He has made it clear that ‘Rebuilding national institutions demands difficult decisions and absolute merit,’ a stance that reassures the public of the government’s commitment to integrity and merit in governance.

PM has emphasized that Pakistan’s economic stabilization is “a long and thorny journey” that hinges on integrity in revenue collection.

Welcoming the move, the businessmen noted that such high-level interventions are rare in Pakistan’s bureaucratic tradition. This rarity underscores the significance of the Prime Minister’s actions, which are a departure from the departmental inertia and political interference that often stall disciplinary proceedings.

The dismissal also reflects a significant shift in the PMO’s monitoring structure. The introduction of real-time intelligence vetting of significant tax fraud cases and the requirement for monthly compliance reports from field formations mark a ‘performance-based accountability grid.’ Under this grid, officers failing to pursue recoveries face immediate review, a change that underscores the impact of the Prime Minister’s reforms.