ISLAMABAD, AUG 15 /DNA/ – Pakistan’s transit trade with Afghanistan remains in deep crisis as restrictive guarantee rules continue to divert cargo to Iranian ports, stripping the country of its hard-won position in regional logistics. Traders warn that the policy is eroding market share that may never return. At the same time, government revenue losses mount and anti-smuggling goals remain unmet.

Under the current regime, bank guarantees with 100-110 percent cash margins are required for all Afghanistan-bound shipments, replacing the insurance guarantees long used to secure transit cargo.

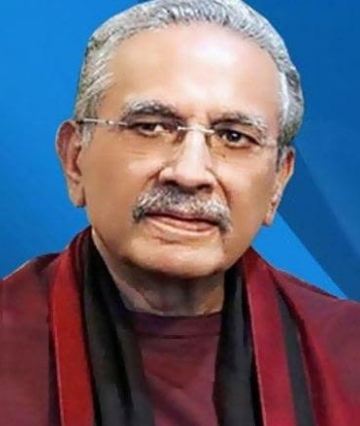

Respected trade leader and former president of the Islamabad Chamber (ICCI) says the shift has made compliance nearly ten times more expensive, pricing out legitimate traders and forcing many to relocate operations outside Pakistan.

Speaking to businessmen, he said that the rule was introduced without consultation and with little understanding of its economic fallout, and was framed to curb smuggling, which it failed to do.

Shahid Rasheed Butt said previously, insurance companies maintained acceptable standing with authorities to issue transit guarantees that covered assessed duties if goods failed to cross the border. Both instruments served the same function, making the exclusion of insurance guarantees illogical.

The fallout has been severe. Afghan importers now face roughly $4,000 in extra costs per container when rerouting through Iran. Monthly container traffic through Pakistan’s transit system, once averaging 6,000 units, has dropped sharply to 600 to 800, hurting truckers, clearing agents, and ancillary services.

A partial reversal followed the foreign minister’s visit to Kabul, reinstating insurance guarantees but limiting them to AA++ rated companies; only three out of dozens in the market. These firms, already profitable in other lines, have imposed steep rates and restrictive terms, effectively keeping most traders out. Medium and smaller insurers, which had developed expertise in the guarantee business, are out of this business entirely, he observed.

The business leader said that court interventions have offered some relief to excluded players. Still, the AA++ rating barrier remains, creating what traders call an “effective oligopoly” that benefits neither the market nor the state.

Experts warn that the policy has dealt a lasting blow to Pakistan’s regional trade ambitions. With Afghan businesses establishing permanent supply chains through Iran, the damage may prove irreversible. Without urgent consultation and structural revisions, Pakistan risks surrendering a strategic trade corridor it spent years building.