ISLAMABAD, JAN 4 (DNA): The Ministry of Finance, in its report, raised serious questions on weak financial management of the oil and gas sector resulting in escalating circular debt.

The ministry has underscored that one of the major weaknesses across the business plans of Pakistan State Oil (PSO), Pakistan Petroleum Limited (PPL), Oil and Gas Development Company (OGDC), Sui Northern Gas Pipelines Limited (SNGPL), and Sui Southern Gas Company Limited (SSGCL) is ineffective financial management.

The prevalence of circular debt, particularly in the energy sector, creates significant cash flow constraints, whereas the delays in payments from other state-owned enterprises (SOEs) and major customers leave these companies with high receivables, affecting liquidity.

The PSO, for instance, has been trapped in this circular debt cycle, which hampers its ability to meet working capital needs and invest in growth projects. Similarly, the SNGPL and SSGCL struggle with collection issues, resulting in weakened financial positions and an over-reliance on government support.

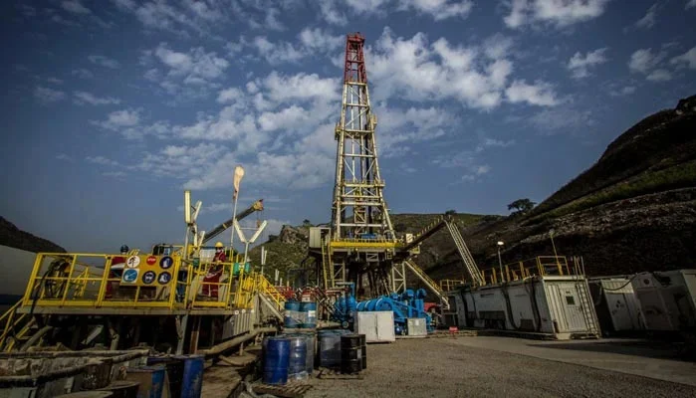

The report said that all five companies face significant challenges due to outdated and inefficient infrastructure. The OGDC and PPL, two of the largest upstream oil and gas companies, continue to operate on ageing extraction and production infrastructure, leading to lower productivity and higher operational costs.

The SNGPL and SSGCL, responsible for gas transmission and distribution, experience high unaccounted-for gas (UFG) losses, which are largely due to obsolete pipelines, leakages and poor metering systems.

Despite awareness of the issue, business plans have been slow to allocate adequate resources for upgrading critical infrastructure, which in turn leads to lost revenues and operational inefficiencies.

Lack of Diversified Energy Investments in the PSO, PPL and OGDC have historically focused on fossil fuels, with limited progress in diversifying their energy portfolios.

While global trends are shifting towards renewable and cleaner energy alternatives, these companies remain heavily reliant on oil and gas, leaving them vulnerable to market volatility and environmental regulations.

The PSO still focuses primarily on the downstream oil sector, with insufficient investment in renewable energy initiatives. This lack of diversification in their business plans makes them susceptible to long-term risks associated with declining global demand for fossil fuels, volatile commodity prices and potential government carbon taxes or environmental penalties.

Another common weakness is the insufficient implementation of hedging and risk management strategies across the companies. Given the volatility of oil and gas prices, the PPL, OGDC and PSO face exposure to price swings that affect their profitability.

Their business plans do not adequately prioritise financial instruments such as futures, swaps, or options to mitigate these risks. In addition, gas distribution companies (SNGPL and SSGCL) lack robust risk management strategies to protect against fluctuating gas supply costs or unexpected disruptions in infrastructure.

Without proactive financial and operational risk management, these companies are left vulnerable to external market and supply chain shocks.