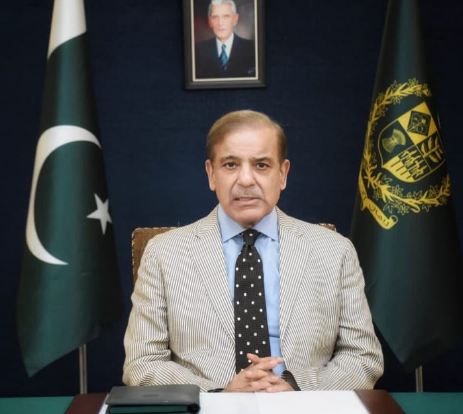

ISLAMABAD, MAR 3 /DNA/ – The Pakistan Business Forum (PBF) on Sunday congratulated Mian Muhammad Shehbaz Sharif to elect as 24th Prime Minister of Pakistan and hope business community will witness now a ‘Pakistan Speed’.

PBF President Khawaja Mehboob ur Rehman, Vice President’s Ahmad Jawad, Jahan Ara Wattoo and PBF Provincial Chairmen Naseer Malik, Daroo Khan Achakzai, Malik Suhail Talat, Atif Ikram Sheikh, Ashafque Paracha included Shabnum Zafar facilitates new Prime Minister and expects the Shehbaz cabinet may provide competitive environment to the business community at large in his new tenure.

PBF President further called for framing a 20 year economic vision for the country including the signing of a charter of the economy by all political parties and a roadmap for economic development.

He said that the vision prepared in this connection should be reviewed after the passage of a period of five years and no government should be allowed to change it on their own.

PBF President said that due to inconsistency in policies and frequent changes in them, we are issuing a huge number of SROs, which should be stopped. So we should have a 20 years vision, which should not be changed by the subsequent governments.

At the moment our exports are about US$ 30 billion and half of it is from the textile sector; Mehboob added.

PBF Vice President Chaudhry Ahmad Jawad said elections have been passed, so now all political parties must show maturity and join hands for the country and its people with the government. So, wisdom and unity must take place, because Pakistan is passing through economic turbulence.

He said constant rise in the electricity tariff is hurting the businesses and indusyry at large. The recent hike of the electricity bills upto Rs 8 per unit as notified by NEPRA, will put the burden of Rs 70 billion on the people of Pakistan.

The Discos’ losses and inefficiencies stood at Rs 77 billion during July-December 2023-24 as compared to Rs 62 billion in the same period of 2022-23, showing addition of Rs 15 billion in total circular debt stock. The total amount of losses, inefficiency were Rs 160 billion during FY 2022-23.

Jawad said policy makers sitting was failing to read the writing on the wall. “Out-of-box thinking is required to emerge from the economic crisis.

PBF official told if energy prices are not slashed by approximately 43 percent, various industries may not survive as high input costs would lead to the loss of export markets, and eventually trigger industrial closures. As we already reeling from skyrocketing inflation from the last three years. One should understand price hikes have made Pakistani exporters “uncompetitive” in the export markets by a large margin.

PBF Chairman South Punjab, Malik Suhail Talat said we expect that the incumbent government will come up with the right set of policies to keep the industrial wheel in motion including revival of cotton crop, as a large chunk of the country’s industries would eventually fall victim to high input cost and close down. It’s also unfortunate that Independent power producers (IPPs) on take-or-pay basis are causing enormous financial burden on consumers across the board, be it households, commercial or industrial users.

We demand that the power sector circular debt issue should be resolved holistically without escalating electricity cost, as its size has more than doubled during the three and a half years in spite of raising the power tariff multiple times in the past.

PBF KP Chairman Ashafque Paracha said corporate tax reforms are essential to spur Pakistan’s economic potential and innovation, thus improving living standard of the people.

At present, corporate tax reforms were imperative for economic growth and sustainability in Pakistan, he said and asserted that the current tax structure was burdened with complexities coupled with high tax rates and loopholes that deters investment, stifles innovation and hinders jobs creation.

Paracha further said reducing corporate tax rates would make Pakistan more competitive globally besides attracting foreign investment and encouraging domestic businesses to expand.