Chaudhry Fawad Hussain appointed new Minister for Information and Broadcasting; Shibli Faraz given science and technology ministry

ISLAMABAD, APR 16 (DNA) – Prime Minister Imran Khan Friday reshuffled his

cabinet changing the portfolios of his government’s key ministers and appointing

Shaukat Fayaz Tareen as a new Minister for Finance and Revenue.

The prime minister appointed Chaudhry Fawad Hussain as Minister for Information

and Broadcasting, replacing Senator Shibli Faraz who interchanged his portfolio with

Fawad as Science and Technology Minister.

Hammad Azhar, previously the industries productions minister, will now be holding the

position of Minister for Energy. He has replaced Omar Ayub Khan who has now been

appointed as economic affairs minister. In place of Hammad Azhar, the prime minister

appointed Makhdoom Khusro Bakhtiar as Federal Minister for Industries and

Production.

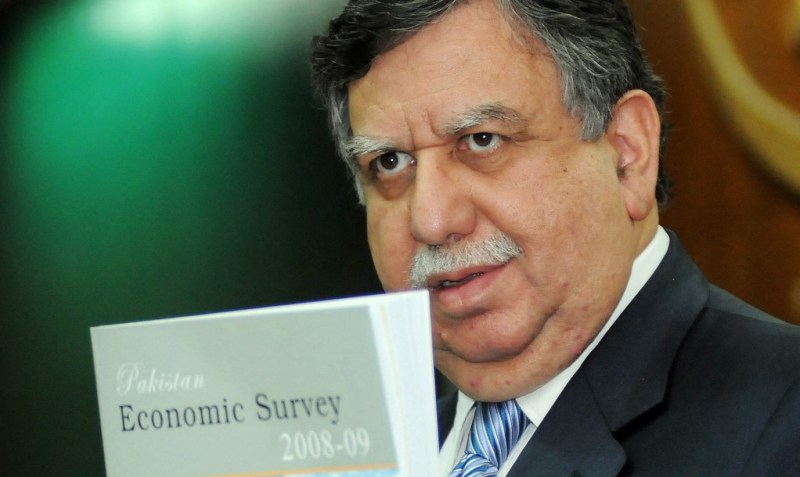

Shaukat Tareen was already a member of the prime minister’s Economic Advisory

Council. He has served as adviser to the PM on finance during the PPP’s tenure and as

finance minister during Musharraf’s era. He is a banker by profession and worked as the

president of HBL in 1997. In 2000, he built Union Bank, which was later sold to

Standard Chartered Bank.

Tareen became a senator and the federal finance minister in president Asif Ali Zardari’s

government. As the finance minister under the PPP government, Tareen signed the

bailout program with the IMF under that government and concluded the seventh NFC

Award.

However, he left the ministry without completing his tenure to start his own bank, Silk

Bank, where he served as its president and CEO. The changes come at a time when

Pakistan has just received another $500 million from the International Monetary Fund

as part of the $6 billion bailout package it signed in July 2019.

The third and latest tranche of the program brings the total borrowing for budget

support to $2 billion. Islamabad had signed the 39-month bailout program with the IMF

to avert sovereign default because of a balance-of-payment crisis. The program will cost

Pakistan $180 million in interest payments at less than 3% to be paid in 10 years.