UNITED NATIONS, May 10 (APP/DNA):A looming global copper shortage could stall the world’s transition to clean energy and digital technologies unless smarter trade and investment strategies are adopted, the UN’s trade and development body, UNCTAD, has warned.

In its latest Global Trade Update, released this week, UNCTAD describes copper as “the new strategic raw material” at the heart of the rapidly electrifying and digitizing global economy.

But with demand set to rise more than 40 per cent by 2040, copper supply is under severe strain – posing a critical bottleneck for technologies ranging from electric vehicles and solar panels to AI infrastructure and smart grids.

“Copper is no longer just a commodity,” said Luz María de la Mora, Director of the International Trade and Commodities Division at UNCTAD.

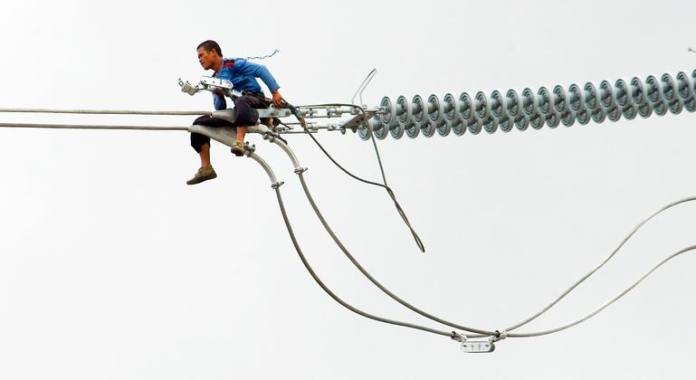

Valued for its high conductivity and durability, copper is essential to power systems and clean energy technologies. It runs through homes, cars, data centres and renewable infrastructure.

Yet developing new mines is a slow and expensive process, and fraught with environmental risks – often taking up to 25 years from discovery to operation.

Meeting projected demand by 2030 could require $250 billion in investment and at least 80 new mining projects, according to UNCTAD estimates.

The Democratic Republic of the Congo holds some of the world’s largest copper reserves, yet most of the metal is exported, limiting the country’s ability to benefit fully from this valuable resource.

Over half of the world’s known copper reserves are concentrated in just five countries – Chile, Australia, Peru, the Democratic Republic of the Congo and Russia.

However, much of the value-added production occurs elsewhere, particularly in China, which now imports 60 per cent of global copper ore and produces over 45 per cent of the world’s refined copper, says the UN.

This imbalance leaves many developing countries stuck at the bottom of the value chain, unable to fully benefit from their resources.

“Digging and shipping copper is not enough,” the report states.

“To move up the ladder, copper-rich developing countries must invest in refining, processing and manufacturing – this means strengthening infrastructure and skills, establishing industrial parks, offering tax incentives and pursuing trade policies that support higher-value production.”

UNCTAD also highlights the challenge of tariff escalation, where duties on refined copper are relatively low – typically below two per cent – but can rise to as high as eight per cent for finished products like wires, tubes and pipes.

These trade barriers discourage investment in higher-value industries and lock countries into roles as raw material suppliers, the report warns.

To address this, UNCTAD is urging governments to streamline permitting, reduce trade restrictions, and develop regional value chains to help developing economies climb the industrial ladder.

With new mining projects facing long lead times, recycling is emerging as a vital part of the solution.

In 2023, secondary sources accounted for 4.5 million tonnes – nearly 20 per cent of global refined copper output. The United States, Germany and Japan are the top exporters of copper scrap, while China, Canada and the Republic of Korea are major importers.

“For developing countries, copper scrap could be a strategic asset,” UNCTAD notes.

“Investing in recycling and processing capacity can reduce import dependence, support value-added trade and advance a more circular, sustainable economy.”

Copper, UNCTAD says, is a likely “test case” for how global trade systems handle rising demand for critical materials amid growing pressures.

“The age of copper has arrived…but without coordinated trade and industrial strategies, supply will remain under strain and many developing countries risk missing out,” the report added.