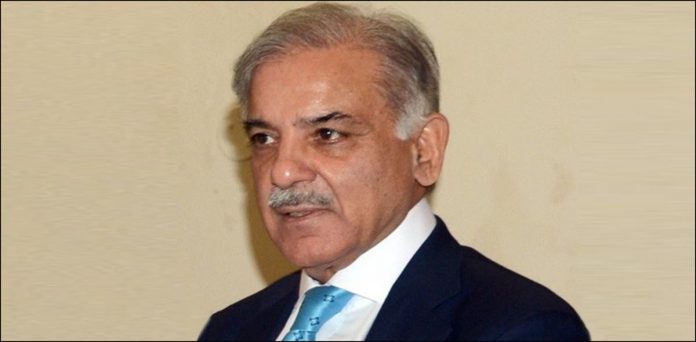

ISLAMABAD, NOV 20 /DNA/ – Prime Minister Shehbaz Sharif has expressed his determination to prevent annual losses of over Rs. 100 billion to the economy from large-scale illegal trade in the unregulated tobacco sector.

During the announcement of the Kissan Package for the agriculture sector, the response given to journalists’ questions shows that the Prime Minister and his economic team are aware of the damage caused by the informal tobacco sector, and committed to reducing its impact on the national economy.

Prime Minister Shehbaz Sharif completely rejected the possibility of giving relief to the unregulated tobacco sector

Moreover, The premier has also directed the Federal Board of Revenue (FBR) to present fresh statistics on the damage caused to the economy by illegal tobacco trade.

It is pertinent to mention that FBR also informed the members of the Public Accounts Committee in its recent meeting that the government could collect Rs 220 by countering tax evasion in the tobacco sector.

The committee was informed that two tobacco companies paid tax of Rs.157 billion while the other 20 companies together paid only Rs. 3 billion. Additional taxes of Rs 60 billion can be collected from the sale of cigarettes, which can increase the value of taxes received from the cigarette industry to Rs. 220 billion.

The statistics presented in the meeting of the Public Accounts Committee prove that more than half of the 50 cigarette manufacturing companies in Pakistan do not even pay nominal taxes and the burden of all taxes on cigarettes is borne by the organized and legal industry.

The volume of illegal cigarette trade has reached 40%, which is the highest proportion in the Asian region.

The federal government implemented a track and trace system to prevent tax evasion from the cigarette industry, however, except for a three companies, most of the cigarette manufacturing companies have not yet been brought under the supervision of this system.