ISLAMABAD, JUL 22 /DNA/ – Pakistan’s top financial regulator, the Securities and Exchange Commission of Pakistan (SECP), is once again at the centre of controversy as it faces contempt of court proceedings for defying judicial orders, a move that has not only embarrassed the institution but further shaken investor confidence in the regulatory environment.

The Islamabad High Court (IHC), during a hearing on July 15 in Contempt Petition No. 172/2025 filed by the United Insurance Company, expressed strong disapproval over SECP’s persistent non-compliance. The court has summoned Nasir Askar, Director of the Licensed and Unlisted Companies Department, to personally appear at the next hearing and explain why directives were ignored.

It is worth recalling that the SECP had suspended United Insurance’s guarantee business on baseless allegations and publicised the move as well. The Islamabad High Court declared SECP’s orders unlawful and issued a stay order, but the SECP failed to comply, prompting UIC to file a contempt of court petition.

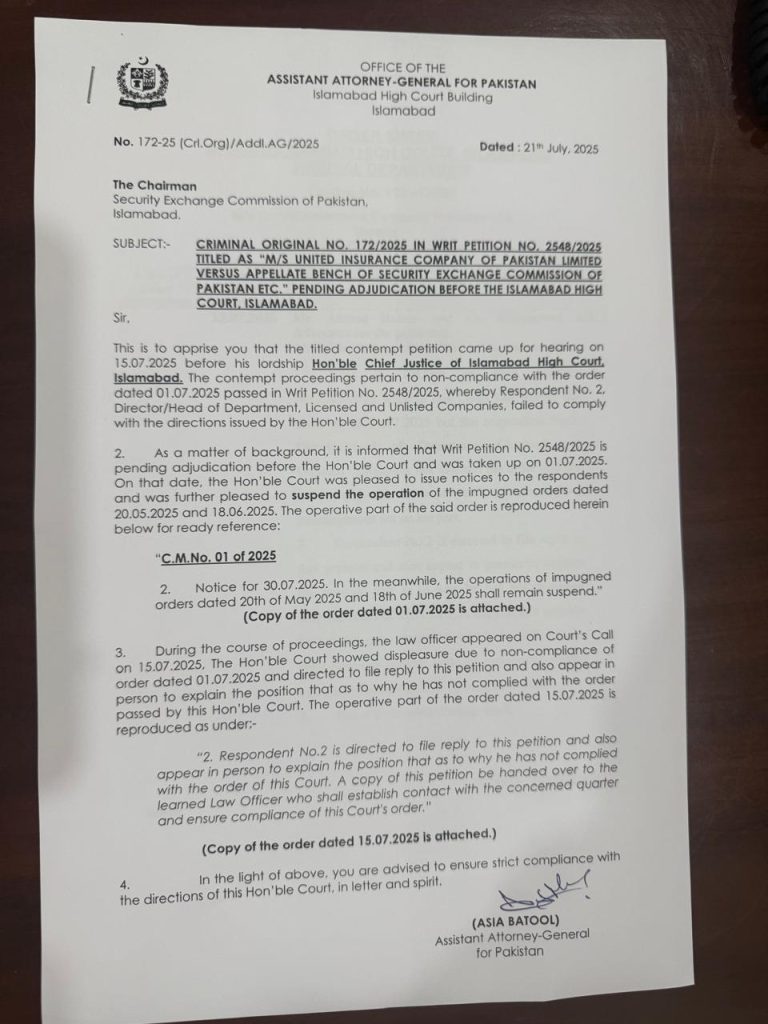

The Office of the Attorney General for Pakistan is growing concerned over SECP’s continued disregard for judicial authority. In a letter addressed to SECP Chairman Akif Saeed dated July 21, 2025, Assistant Attorney General Asia Batool noted that the SECP has repeatedly failed to implement court instructions related to licensing matters. The court has now stayed previous directives until the next hearing and demanded a written explanation from the SECP official Nasir Askar, warning of serious consequences for further defiance.

Legal experts say the issue goes beyond a procedural lapse. “This points to a dangerous culture inside a regulatory body. The SECP is not above the law,” said a constitutional lawyer, describing it as a symptom of deeper governance failures.

The episode adds to SECP’s growing credibility crisis. Market observers warn that unchecked regulatory misconduct, particularly in sensitive sectors such as insurance, erodes investor trust and disrupts business continuity. “The regulator is sending a negative signal to both local and foreign investors.

This is not the first time SECP has come under fire for ignoring legal or procedural norms. Still, public censure by the IHC marks a new low in institutional accountability. As legal uncertainty rises, investment flows may slow, and the cost of regulatory risk is expected to increase.

The case will be heard again on July 30. Without immediate corrective action, SECP faces deeper institutional damage, possible fines, and a shrinking public mandate.